Our Holistic Planning Approach Involves the Following Areas

Our Holistic Planning Approach Involves the Following Areas

Estimate the annual required distribution from your traditional IRA or former employer's retirement plan after you turn age 73.

CalculateThe stocks in the S&P 500 are classified by 11 sectors, each of which responds differently to market conditions.

The SECURE Act of 2019 dramatically changed the rules governing how IRA and retirement plan assets are distributed to beneficiaries.

A convertible bond is a regular corporate bond that comes with a special added feature: the investor has the right to convert it into shares of that company’s common stock.

Making a peer-to-peer (P2P) payment is a convenient way to transfer money to family, friends, or businesses — these precautions can help avoid costly mistakes.

Estimate the annual required distribution from your traditional IRA or former employer's retirement plan after you turn age 73.

Use this calculator to estimate how much income and savings you may need in retirement.

Will you be able to afford nursing home care?

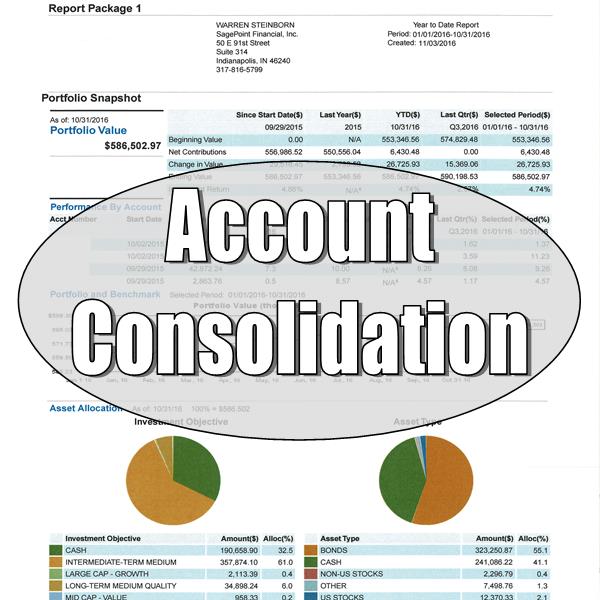

Use this calculator to estimate the federal estate taxes that could be due on your estate after you die.